Table of Contents

- Understanding Health 1st Insurance Benefits and Coverage Options

- Navigating the Enrollment Process for Health 1st Insurance

- Maximizing Your Health 1st Insurance Plan for Optimal Care

- Common Myths About Health 1st Insurance Debunked

- Tips for Managing Costs and Claims with Health 1st Insurance

- Q&A

- Final Thoughts

Understanding Health 1st Insurance Benefits and Coverage Options

Health 1st Insurance offers a variety of benefits and coverage options designed to meet the diverse needs of its policyholders. With a focus on both preventative and comprehensive care, members can access a range of services to maintain their well-being. Among the key benefits are:

- Preventive Services: Coverage for annual check-ups, vaccinations, and screenings to catch health issues early.

- Specialist Access: The ability to consult with specialists without needing a referral, ensuring prompt and targeted care.

- Prescription Drugs: A variety of medications are covered, with options for both generic and brand-name prescriptions.

Additionally, Health 1st provides flexibility with several tailored plans. Members can choose from a range of deductibles and co-pay structures to suit their financial preferences. Below is a simplified comparison of common plan features:

| Plan Type | Deductible | Co-Pay for Visits |

|---|---|---|

| Basic Plan | $1,000 | $30 |

| Standard Plan | $500 | $20 |

| Premium Plan | $0 | $10 |

This structure allows members to select a plan that aligns with their health needs and financial situations. With a commitment to customer care, Health 1st Insurance also offers 24/7 support to address any queries or concerns regarding coverage, making it an accessible option for those navigating their health insurance options.

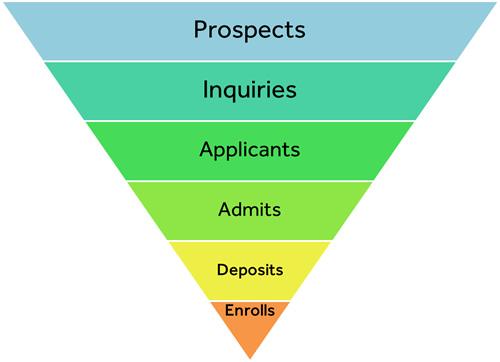

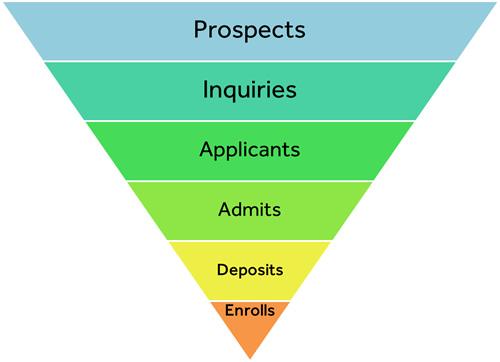

Navigating the Enrollment Process for Health 1st Insurance

When considering Health 1st Insurance, understanding the enrollment process is crucial for securing the right coverage. The first step is to gather personal information, including your Social Security number, date of birth, and employment details. Have your medical history at hand as this will help in determining your eligibility and coverage options. Make sure to review the required documentation to ensure a smooth application process.

Next, exploring the different plans available is essential. Health 1st Insurance offers various options tailored to meet diverse healthcare needs. Consider factors like premiums, deductibles, and out-of-pocket maximums when comparing plans. To help you make an informed decision, here’s a brief overview of key plan types:

| Plan Type | Coverage Features |

|---|---|

| HMO | Lower premiums but requires referrals for specialists |

| PPO | More flexibility in choosing providers with higher costs |

| POS | Hybrid of HMO and PPO with in-network and out-of-network options |

once you have identified the plan that best meets your needs, it’s time to complete the application. You can typically enroll online, over the phone, or via a paper application. Be prepared to provide the necessary information, as well as any additional documentation required. After submitting your application, Health 1st Insurance will review your information and send you a confirmation once your enrollment is successful, allowing you to start enjoying your health coverage promptly.

Maximizing Your Health 1st Insurance Plan for Optimal Care

To ensure you’re making the most of your Health 1st insurance plan, it’s essential to understand its features and benefits fully. This knowledge empowers you to make informed choices when it comes to your healthcare. Start by familiarizing yourself with your policy specifics, such as coverage limits and exclusions. Here are a few key aspects to consider:

- Network Providers: Utilize in-network doctors and specialists to maximize your benefits and minimize out-of-pocket costs.

- Preventive Services: Take advantage of covered preventive services such as vaccinations, screenings, and annual physicals.

- Prescription Coverage: Review your prescription drug coverage to better manage medication costs.

Another vital strategy is to keep track of your healthcare expenses and usage. Regularly reviewing your medical bills, claims, and insurance statements can help you identify any discrepancies and ensure you’re receiving all entitled benefits. Implement a system that works for you, such as:

- Annual Health Checklist: Create a yearly checklist of necessary appointments and preventive care.

- Health Tracking Apps: Use mobile apps or online tools for managing and tracking your healthcare information.

- Claim Monitoring: Stay proactive about checking the status of your claims to expedite processing.

Engaging in open communication with your healthcare providers is equally important. Don’t hesitate to ask questions about your treatment options or costs associated with procedures. Building a strong patient-provider relationship can lead to better outcomes and comprehensive care. Consider the following ways to foster this connection:

- Be Informed: Research your health conditions and treatment options before appointments.

- Set Goals: Discuss your healthcare goals with your provider to ensure aligned priorities.

- Follow-Up: Schedule follow-up appointments to address any ongoing concerns or adjustments needed in your care plan.

Common Myths About Health 1st Insurance Debunked

There are several misconceptions surrounding Health 1st Insurance that can deter individuals from exploring their options. One prevalent myth is that it only covers basic health services, leaving patients to pay out-of-pocket for more specialized treatments. In reality, Health 1st plans often include a robust network of specialists and comprehensive coverage options that cater to a wide array of medical needs. By thoroughly reviewing policy details, members can find coverage for preventive care, chronic illness management, and emergency services.

Another common belief is that health insurance is unaffordable, particularly for those with limited income. However, many Health 1st Insurance plans offer various pricing tiers and financial assistance programs tailored to individual circumstances. This means that even those operating on a tight budget can access quality health care. It’s essential to compare different plans and consult with an insurance representative to identify the most cost-effective solutions available.

some individuals think that enrolling in Health 1st Insurance is a complicated and time-consuming process. While it may seem daunting at first glance, the reality is that many insurance providers prioritize user-friendly experiences. With online portals and helpful customer service representatives, members can easily navigate the enrollment process. Consider the following features that simplify signing up:

| Feature | Benefit |

|---|---|

| Online Enrollment | Complete application at your convenience. |

| Comprehensive Guides | Step-by-step instructions available. |

| Customer Support | Reach a representative for personalized assistance. |

Tips for Managing Costs and Claims with Health 1st Insurance

Managing costs and claims effectively with Health 1st Insurance is crucial for maximizing your benefits while minimizing out-of-pocket expenses. An essential first step is to familiarize yourself with the network of healthcare providers included in your plan. Utilizing in-network doctors and hospitals can lead to reduced copayments and maximize your coverage. Keep an updated list of these providers handy and consider scheduling routine check-ups and preventive care to stay proactive about your health and costs.

Understanding your policy’s terms is another critical component in successfully managing costs. This includes knowing your deductible—the amount you must pay out of pocket before your insurance kicks in—as well as your copayment and coinsurance responsibilities. Create a simple spreadsheet to track your medical expenses against your deductible. This approach not only aids in budgeting but can also help you manage when to seek care based on your financial situation.

Here’s a quick overview of some common terms you should know:

| Term | Definition |

|---|---|

| Deductible | The total amount you pay for healthcare before your insurance pays. |

| Copayment | A fixed amount you pay for a specific health service, usually at the time of service. |

| Coinsurance | The percentage of costs you pay after your deductible has been met. |

When it comes to filing claims, streamline the process by keeping meticulous records of all your healthcare expenses. Before scheduling any procedure, verify coverage with Health 1st Insurance to avoid unexpected costs. Additionally, promptly submitting all necessary documentation along with your claims will ensure timely reimbursement. It may also be beneficial to set reminders for following up on any outstanding claims to stay informed about the status and resolve issues quickly if they arise.

Q&A

Q&A on Health 1st Insurance

Q1: What is Health 1st Insurance?

A1: Health 1st Insurance is a health insurance provider that focuses on offering customizable plans tailored to individual and family needs. The goal is to provide comprehensive coverage that emphasizes preventive care and enhances overall wellness, ensuring clients have the support they need during their healthcare journey.Q2: Who is eligible for Health 1st Insurance?

A2: Health 1st Insurance plans are designed for a wide range of customers, including individuals, families, and small businesses. Eligibility typically requires applicants to be within specific age ranges and meet certain health criteria, though the focus is generally on inclusivity and accessibility to facilitate the well-being of as many people as possible.Q3: What types of plans does Health 1st Insurance offer?

A3: Health 1st Insurance offers various plans, including individual health plans, family packages, employer-sponsored insurance, and short-term coverage options. Each plan can be tailored with a variety of add-ons, such as dental, vision, and wellness programs, to best fit the needs of the insured.Q4: How does Health 1st Insurance compare to other health insurance options?

A4: What sets Health 1st Insurance apart is its strong emphasis on preventive care and wellness initiatives. While many insurance providers focus primarily on treatment coverage, Health 1st prioritizes support systems to help clients maintain their health proactively, potentially reducing long-term healthcare costs and improving quality of life.Q5: Are there any waiting periods for coverage under Health 1st Insurance?

A5: Yes, like most health insurance plans, Health 1st Insurance may have waiting periods for certain conditions or treatments. These policies are in place to manage risk and ensure fairness among policyholders. It is advisable to review the specific terms of each plan to understand any applicable waiting periods.Q6: How can I file a claim with Health 1st Insurance?

A6: Filing a claim with Health 1st Insurance is straightforward. Policyholders can submit claims via the company’s website, through a mobile app, or by contacting customer support directly. All claims require specific documentation, such as receipts and medical records, so it’s important to have these prepared to facilitate a quicker resolution.Q7: What customer support options are available?

A7: Health 1st Insurance offers a range of customer support avenues, including phone support, email assistance, and live chat options. They also provide an extensive online help center where policyholders can access resources, FAQs, and guides to better understand their plans and services.Q8: How can I cancel my Health 1st Insurance policy?

A8: If you decide to cancel your Health 1st Insurance policy, you can do so by contacting customer service directly or through your online account. It’s essential to review the cancellation terms associated with your plan, as there may be refunds or fees applicable depending on the timing and details of your cancellation.Q9: Does Health 1st Insurance cover alternative therapies?

A9: Health 1st Insurance recognizes the importance of holistic approaches to health and wellness. Certain plans may offer coverage for alternative therapies such as acupuncture, chiropractic care, or naturopathy, though this can vary based on the specific policy. Reviewing the plan details or speaking with a representative can provide clarity on coverage options.Q10: How do I find the right plan with Health 1st Insurance?

A10: To find the right plan with Health 1st Insurance, start by assessing your healthcare needs, budget, and preferred coverage level. The company provides a user-friendly online tool to help compare different plans and their benefits, along with personalized assistance from their team to ensure you choose the best option for you and your family.This Q&A format provides a clear overview of Health 1st Insurance, answering potential questions from prospective customers while maintaining an informative and neutral tone.

0 Comments